How to File Taxes Online Securely in 2024

Oh no, it’s that time of the year again – tax season. Time to break out the calculator and navigate through complex Internet Revenue Service (IRS) instructions! You might get a sweet tax return, but if you’re not careful, you can become a victim of fraud.

Most people file online, making this month a virtual playground for cybercriminals trying to steal your identity or financial info. Tax season is frustrating enough—don’t let a cybercrook turn it into a living nightmare.

The best way to file securely is to subscribe to Private Internet Access’s (PIA) virtual private network (VPN). We’ve spent the last decade perfecting our VPN to give you ultimate privacy, especially during tax season.

Keep reading to learn how to file taxes online without worrying about scams or malicious third parties. The IRS is the only thing you should worry about!

How to Find Out if You Need to File a Tax Return

If you made money in 2021, you’ll most likely have to file a tax return. That’s true if you made your income through a regular job, freelance work, contracting, or running your own business. It’s also true if you were unemployed but received unemployment benefits or a COVID-19 stimulus check.

That said, the IRS has a few exceptions. If you fall into these categories, congratulations – you get to avoid tax season:

- If you’re a dependent (i.e. somebody, probably your parent, is claiming you on their tax returns) and you make less than $1,100.

- If you’re not a dependent and earn less than the standard deduction ($12,500), unless you are self-employed.

- If you only receive Social Security benefits and don’t make any other income. In some cases you might still have to pay taxes. Online software like TurboTax can help you determine if you need to pay taxes on Social Security.

Need to file a tax return? See below for how to file taxes online securely with PIA VPN.

State Taxes vs. Federal Taxes

The feds aren’t the only ones that want a cut of your paycheck. Your state also levies taxes against your income. Like your federal return, you’ll get a state tax return.

Tax codes vary state by state, so things get confusing when you start your state taxes. This is one reason people prefer using online software like Turbotax.

Between federal and state taxes, you’ll be sending digital information all over the internet, which gives cybercriminals plenty of opportunities to steal your data.

Without a VPN, malicious third parties will have free reign to steal your identity or commit fraud. Connect to a PIA server to automatically encrypt your data and make your financial information unreadable to nosey third parties.

How Can I File Taxes as an Individual?

You can file your taxes through old-school snail mail or online. Paper filing is more secure, but is much more difficult. You’ll need to print out all the forms, fill them out, and perform calculations by hand. If you choose this option, you’ll probably need an accountant for help.

Online filing is much easier. The IRS has online tools, and private companies provide commercial options. Turbotax is the most popular. Unfortunately, electronic filing opens you up to malicious third parties and the chance your data will get stolen. If your data isn’t encrypted, any fraudster can look at it.

Subscribe to PIA and get the best of both worlds. Enjoy electronic filing ease while keeping your data secure.

How Do I File My Taxes?

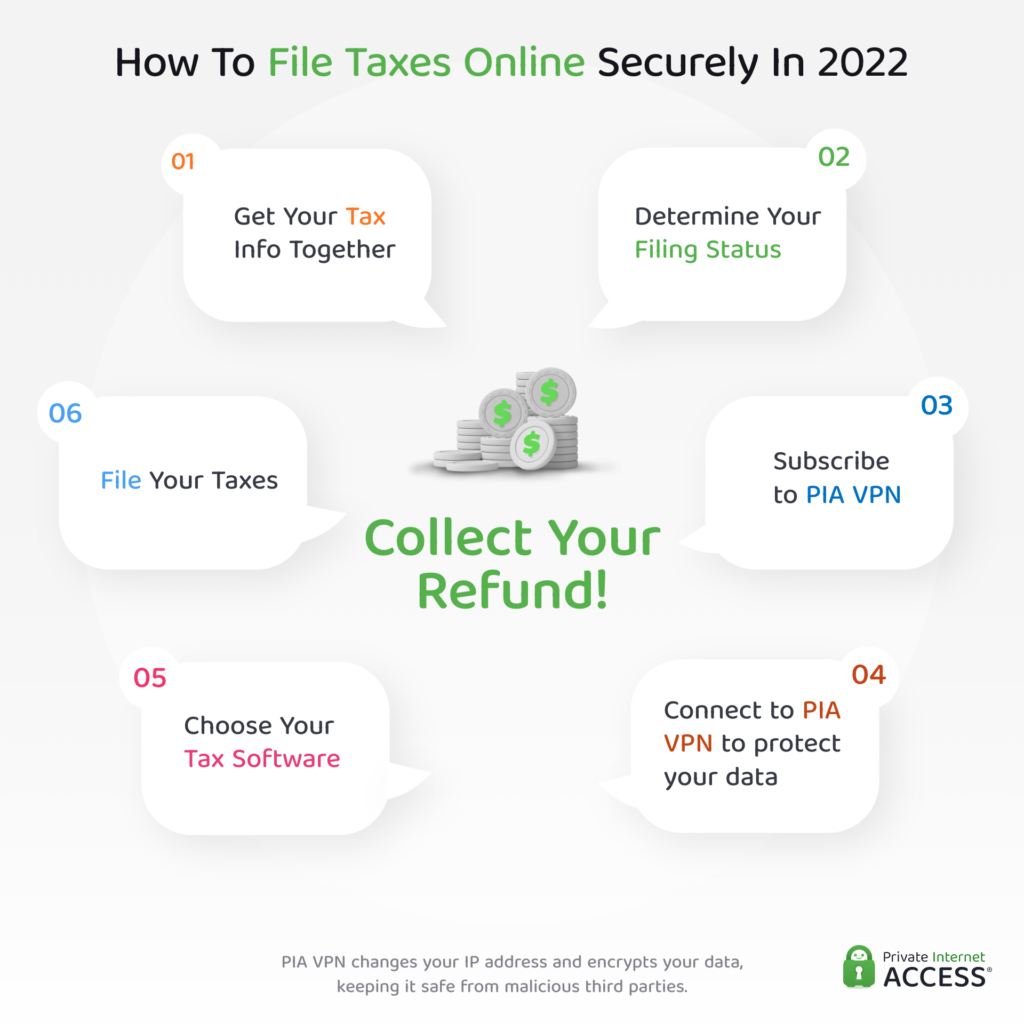

Ready to file? Gather up all your documents and follow this step-by-step process to file your taxes securely.

File Within the US

- Determine if you have to file taxes. See the above section for that.

- Collect all your tax documents.

- Determine your filing status. The IRS has five filing statuses: single, married filing jointly, married filing separately, unmarried head of household, or qualifying widow or widower with a dependent child.

- If you want to file manually through the mail, follow these steps:

- Go to your library and pick up your tax forms.

- Follow the instructions on the forms.

- Determine how much you owe.

- Attach all relevant documentation to your tax forms.

- Mail your tax forms.

- Pay online or through the mail.

- If you want to file electronically (which we recommend), follow these steps:

- Choose IRS-approved tax software like TurboTax or H&R Block. Many of these let you file online. You can also use the official IRS Free File system if you qualify.

- Make sure you are filling safely. Use PIA VPN, make sure your device doesn’t have malware, and use a secured connection.

- Follow the step-by-step process in the software.

- Print off your documents and send them by mail or e-file through the software.

- Collect your refund or pay your taxes via electronic payment or mail.

File as an American Expat

Living abroad? Uncle Sam still wants your taxes! Here’s how you can file your taxes if you’re not currently in the US.

- Choose IRS-approved tax software, IRS Free File, or request US tax documentation. The filing process is still the same if you’re an expat – you’ll report your income as foreign income. We recommend IRS-approved tax software; it’ll guide you through the process.

- Make sure you use a VPN. Internet Service Provider (ISP) snooping is the norm in most countries. You don’t want to expose your US income to third parties. If you forget to encrypt your data with a VPN, anyone watching can view your financial information.

- Collect your refund or pay your taxes via electronic payment or mail.

How to File My Taxes on an Unsecured Connection

Don’t trust unsecured connections like public Wi-Fi to keep your tax information safe, especially if you’re filing taxes on the go.

Use a VPN to protect your information. A VPN is a private server network that lets you route your traffic through a secure server. The server encrypts your data and you get a new IP address from the server’s location. Third parties and cybercrooks can’t read encrypted data, so you won’t have to worry about somebody stealing your info.

Even if you’re not on an unsecured network, a VPN is still a good idea. You can never be too careful, especially during tax season.

How PIA VPN Protects Your Data

Subscribe to PIA and get cutting-edge protection this tax season. We’re constantly working to make our VPN the most secure tool for your privacy needs. PIA offers:

- A Strict No-Logs Policy: We’ll never record what you do while connected to a PIA server, including any financial info you transfer. The only data we’ll ever collect is whether the VPN works (i.e. if a connection was made or dropped.) That’s it.

- Iron-Clad Encryption: Choose AES-128 or AES-256 encryption, or no encryption. This way, you can control the trade-off between encryption and connection speed.

- VPN Flexibility: Choose between several remote and local ports. Also, we let you choose your own domain name server (DNS) so you can customize your protection to fit your needs.

- Lightning-Fast Speeds: Enjoy NextGen servers. We’ve spent a decade ensuring fast speeds and stable connections. Our cutting-edge hardware gives you 10Gbps bandwidth.

- Automatic Kill Switch: Forget about data leaks. PIA includes an advanced kill switch, which you can use to stop internet traffic outside the VPN tunnel whether or not the VPN is on.

- Full Transparency: PIA’s source code is publicly available, so anybody can see how our VPN works. Have an idea for how to improve the source code? Ask for the change on our GitHub repository!

Pay Now… So You Won’t Pay More Later

Tax season’s a pain. Don’t expose your data to malicious cybercrooks and make the season worse. PIA gives you cutting-edge protection to keep your financial data safe and fraud-free.

FAQ

Most likely. If you made money in 2021, you’ll need to file a tax return with the IRS. The IRS makes exceptions for people who earned less than the standard dedication, dependents, and social security receivers.

While researching your tax situation, use PIA VPN to hide your financial data from third parties.

First things first: decide if you’re filing electronically or manually. Then, collect all your tax information and get going on your return.

See the above steps to get your best tax return and subscribe to PIA to protect your financial data this tax season.

As soon as you’d like! April 18, 2022 is the tax deadline this year, but you don’t have to wait until then to start working on your taxes. As part of the process, make sure to use a VPN to stop cybercrooks from snooping on you.

Reach out to our customer support team if you have questions about setting up PIA VPN before the tax deadline.

Yes, if you earn less than $73,000, you might qualify to use the IRS’s free tax filing software.

Of course, you can also file manually for free, but that’s a more difficult way to file your taxes.

Use PIA VPN to stay anonymous during online filing and keep your info safe from cybercrooks.

First, go to the IRS Free File tool. This will provide you with free filing options if you qualify. Then, go to any of the recommendations and file for free.

Like TurboTax and other software, you’ll submit your information online. That means it’s critical to ensure your online privacy with a VPN. You want your tax information going only to the IRS, and nobody else.